In What Manner Does Depreciation Expense Affect Investment Projects

In what manner does depreciation expense affect investment projects. Because it is an expense it is inversely proportional to the profitability of an enterprise.

Solved In What Manner Does Depreciation Expense Affect Chegg Com

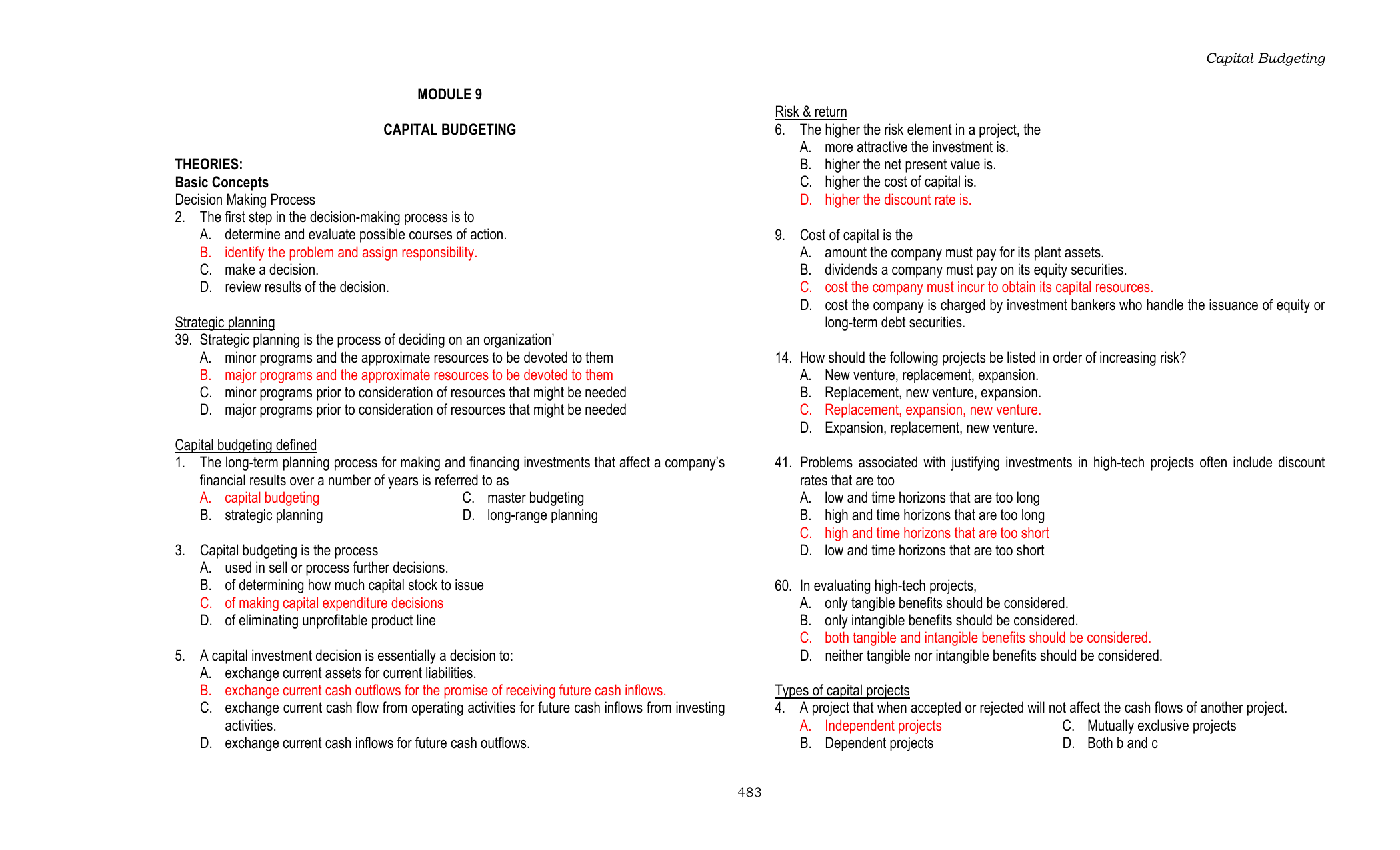

Depreciation is allocated so as to charge fair proportion of depreciable amount in each accounting period during the useful life of the asset.

. It increases cash flows by the amount of the depreciation expense. It increases cash flows by the amount of the depreciation expense. It increases taxable income by the amount of the depreciation expense.

What Does Tax Depreciation Mean. In what manner does depreciation expense affect investment projects. Depreciation is an accounting method of deferring the expense of capital asset items so that the cost of an item is spread out over the useful life of the item rather than taking the full cost of the item in the year.

In what manner does depreciation expense affect investment projects. Assuming a 20 tax rate Net Income decreases by 8. It reduces cash flows by the amount of the depreciation expense.

It reduces taxes by the amount of the depreciation expense. Depreciation is the systematic allocation of the cost of a companys assets used in its business from the balance sheet to the income statement as an expense over their estimated useful lives. In what manner does depreciation expense affect investment projects.

When it is in the location and condition necessary for it to be capable of operating in the manner intended by the management. When creating a budget for cash flows depreciation is typically listed as a reduction from expenses thereby implying that it has no impact on cash flows. It reduces taxes by the amount of the depreciation expense.

What are the effects of depreciation. It reduces taxable income by the amount of the depreciation expense Your forecast shows 500000 annually in sales for each of the next 3 years. Depreciation is the gradual decrease of the fixed assets cost over its useful life.

It reduces cash flows by the amount of the depreciation expense. Since the amount of depreciation never actually left our bank account in the form of expenses we still have it in cash. The depreciation expense amount changes every year because the factor is multiplied with the previous periods net book value of the asset decreasing over time due to accumulated depreciation.

This is because it is a non cash expense and ideally should not have any effect on the cash flows. The Bottom Line. Depreciation is treated as an expense in the business.

For example if a company buys a vehicle for 30000 and plans to use it for the next five years the depreciation expense would be divided over five years at 6000 per year. It reduces taxable income by the. Depreciation of an asset begins when it is available for use ie.

It increases cash flows by the amount of the depreciation expense. Meaning of Depreciation. It reduces cash flows by the amount of the depreciation expense.

This is the reason why it is added back during cash flow calculations. It increases cash flows by the amount of the depreciation expense. There are four main methods of depreciation.

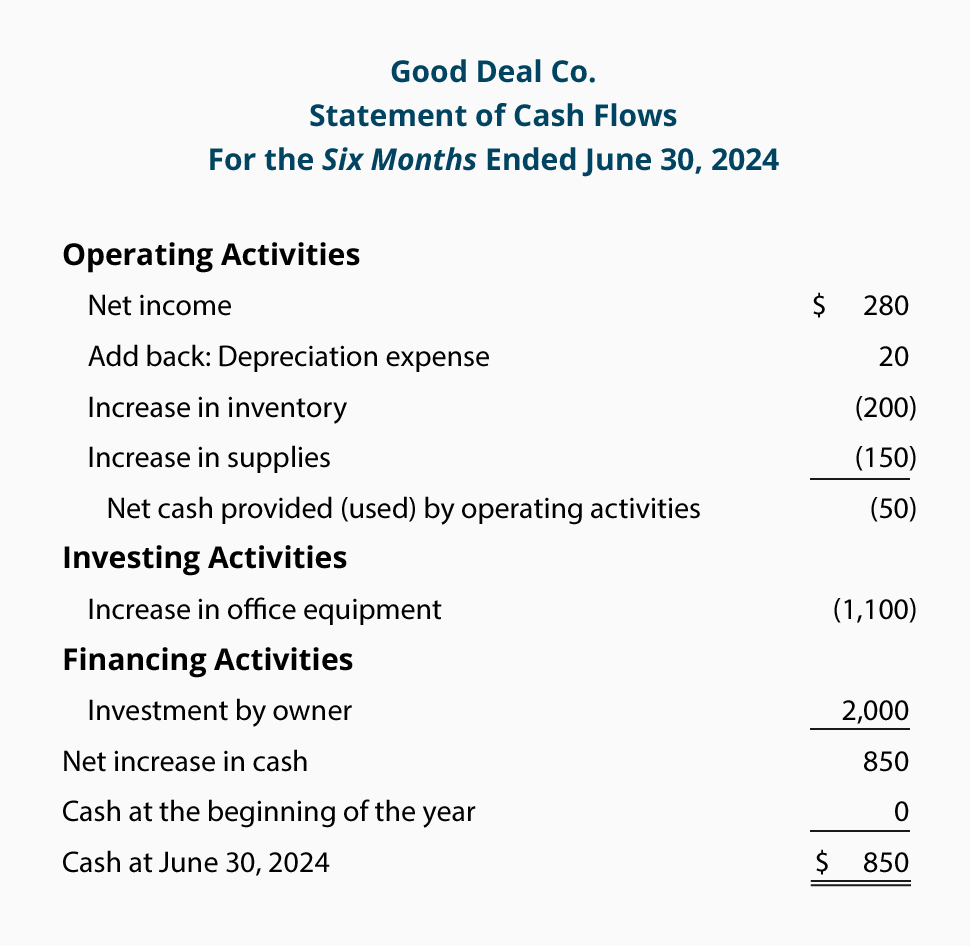

Depreciation can make a difference between a project that is justified and one that is not. On the Cash Flow Statement under Cash Flow from Operations Net Income decreases by 8. Periodic Depreciation Expense Beginning Value of Asset Factor Useful Life.

In what manner does depreciation affect cash flows of an investment projects. Why is it likely that firms would use straight-line depreciation methods for depicting project analysis to shareholders or lenders if such choice were possible. Cit reduces taxable income by the amount of the depreciation expense.

It reduces taxable income by the amount of the depreciation expense. Cit mirrors the market value of the assets. Tax depreciation is a process by which taxpaying businesses write off the depreciation as an expense on their tax returns.

The three depreciation methods affect pre-tax income tax expense and other elements in different ways. Bit increases cash flows by the amount of the depreciation expense. But we need to add back the 10 increase in Depreciation because its a non-cash expense.

Ait increases the NPV of the project. It reduces taxable income by the amount of the depreciation expense. The accelerated methods of depreciation cause the pre-tax income income tax expense net income and profit margins to be lower in the initial years and higher in the later life of the asset as compared to that of the straight-line.

Depreciation is the process of deducting the cost of a business asset over a long period of time rather than over the course of one year. Depreciation is considered a non-cash expense since it is simply an ongoing charge to the carrying amount of a fixed asset designed to reduce the recorded cost of the asset over its useful life. This allows businesses to recover the cost that theyve invested in a certain type of asset.

Starting with the Income Statement Depreciation goes up by 10 which causes Pre-Tax Income to decrease by 10. The depreciation will have little impact on capital investment decisions since capital expenditure incurred on fixed assets is considered as sunk cost and it. Ait reduces cash flows by the amount of the depreciation expense.

It reduces taxable income by the amount of the depreciation expense. Or in simple terms the more the depreciation charged the less is the profit. Dit allows asset balances to decline more slowly.

It reduces taxes by the amount of the depreciation expense. It increases cash flows by the amount of the depreciation expense. Depreciation is an important concept in capital budgeting.

In what manner does depreciation expense affect investment projects. It reduces cash flows by the amount of the depreciation expense. Depreciation occurs through an accounting adjusting entry in which the account Depreciation Expense is debited and the.

Dit reduces taxes by the amount of the depreciation expense. In what manner does depreciation expense affect investment projects. It reduces cash flows by the amount of the depreciation expense.

Accumulated depreciation is a running total of the depreciation expense that has been recorded over the years and is offset against the sale of the asset. It can also influence the choice of equipment that is needed for a particular project. Bit decreases the tax liability of the project.

It does not impact net. It reduces taxes paid by the amount of depreciation tax shield.

No comments for "In What Manner Does Depreciation Expense Affect Investment Projects"

Post a Comment